Posted by

John Nicklas

EBITDA is often used and confused as an approximation of operating cash flow. Many business professionals (CPAs, business owners, bankers, attorneys and others) struggle to understand the differences between EBITDA and cash flow from operations within a business. Below are some differences between these business metrics.

Definitions of each as provided by Investopedia.com:

- “EBITDA” is essentially net income with interest, taxes, depreciation, and amortization added back to it, and can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

- “Operating Cash Flow” or “OCF” is (in accounting) a measure of the amount of cash generated by a company's normal business operations. Operating cash flow is important because it indicates whether a company is able to generate sufficient positive cash flow to maintain and grow its operations, or whether it may require external financing. OCF is calculated by adjusting net income for items such as depreciation, changes to accounts receivable, changes in inventory and other working capital items.

A few comments about EBITDA:

- EBITDA is used widely and is easy to calculate by taking income from operations (reported on the income statement before interest and taxes) and adding back depreciation and amortization (reported as a line item or items in the cash flow statement).

- EBITDA is used everywhere, from valuation multiples to the formulation of covenants in credit agreements. It is the “go to” or “de facto” metric in the business community.

- EBITDA allows you to compare the profitability of different companies by cancelling the effects of a company’s capital, financing and tax entity structure.

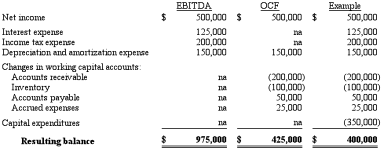

In the table above, Operating Cash Flow(“OCF”) does a better job of adjusting for the increasing working capital needs of a growing company, but fails to add back interest expense and income tax expense, items that make it easier to compare businesses with different capital and entity tax structures.

In addition to the fluctuation of working capital, we should include “normal” capital expenditures in our evaluation of the profitability of a company. Capital expenditures are necessary to support production and maintain a company’s asset base. As presented in the table above, capital expenditures may significantly impact cash flow if the business is capital intensive and/or has a need for expanded capacity or updated equipment.

EBITDA is, and will probably always be, the key business metric for evaluating the performance of a business to its peer group because it is widely used and easy to perform. However, keep in mind that EBITDA is not cash flow and that many other factors should be considered.

John Nicklas is a Vice President in

our Assurance Service Group at Meaden & Moore. He has over 19 years

of experience serving the accounting and business advisory needs of

middle-market companies. He is born and raised in Northeast Ohio and

works in our Cleveland office.